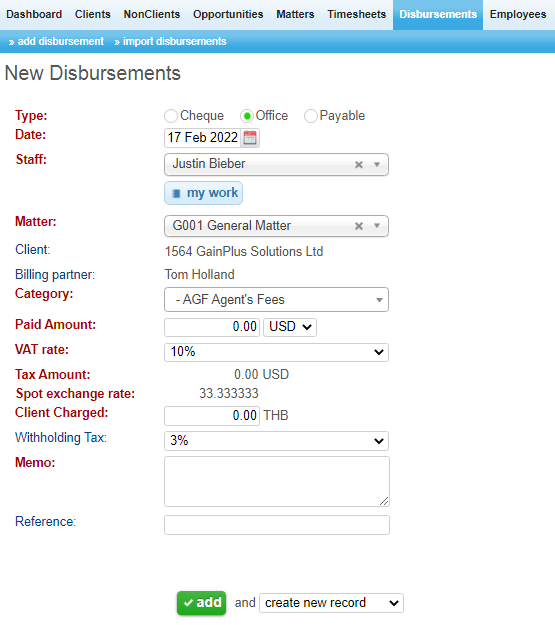

To add a new disbursement begin by clicking on the Disbursements menu located in the menu bar. Next, select add disbursements. Once that has been done, complete the following steps:

1. Select the type (cheque/ office / payable)*.

2. Select the date.

3. Select the staff which incur expense.

4. Begin typing the client name in the Client field and then select the client from the list of available choices. Alternatively, you can search by matter by selecting the “search by matter” button located above the client field.

If your company has limited number of open matters then there will be one list with matter selection instead.

5. Select the appropriate matter from the drop-down list by clicking in the matter description field. Note: If you searched by matter it will automatically populate the client field based on your selection.

6. Select category of the expense.

7. Enter the disbursement amount, tax rate and the system will calculate charge to client.

8. Fill in the memo field.

9. At this point if you selected office disbursement the next field will be titled reference. This is an optional field in which you can add additional information about the disbursement before selecting the add button to complete the process. If you are entering information for a cheque or payable disbursement, you will have the option of including the following additional information like Invoice from; supplier invoice no; effective date; payee; cheque no; remit to; bank account etc.

10. Finally click ADD button to record expense in the system.

*Office disbursements are internal, these can be thought of as petty cash type expenses. Cheque disbursements are outside and would typically have additional information associated with them such as bank details, cheque number to be recorded, etc. An example of this would be a disbursement paid to an agent providing service to the firm on behalf of a client. Payable disbursement would be invoice from supplier that you have to manage separately either in TaBS or accounting system.

**The fields labeled “amount” and “charge to client” enable the user to set different amounts for the cost of the disbursement to the firm and the amount that is charged to the client for that disbursement. Additionally, the field is helpful when converting disbursements spent in one category to the currency the client is billed in, if the two are different.